10 Essential Insights into FDI Trends, Economic Resilience, and the Evolution of the Timber Industry

Robust GDP Growth Surpasses Expectations

Vietnam’s economy demonstrated remarkable resilience in 2025, achieving a GDP growth rate exceeding 6.5%. This growth was fueled by a strong recovery in global manufacturing demand and stable domestic consumption. The country continues to lead Southeast Asia as a primary hub for industrial expansion and economic stability.

Source: General Statistics Office (GSO) of Vietnam / World Bank 2025 Report

High-Quality FDI Inflows Reach New Heights

Total Foreign Direct Investment (FDI) hit record levels in 2025, with a significant shift toward high-tech and sustainable projects. Global investors are increasingly prioritizing Vietnam for automated manufacturing facilities rather than just low-cost labor. This influx of capital has accelerated the modernization of local infrastructure and industrial parks.

Source: Ministry of Planning and Investment (MPI) / Vietnam Economic Times

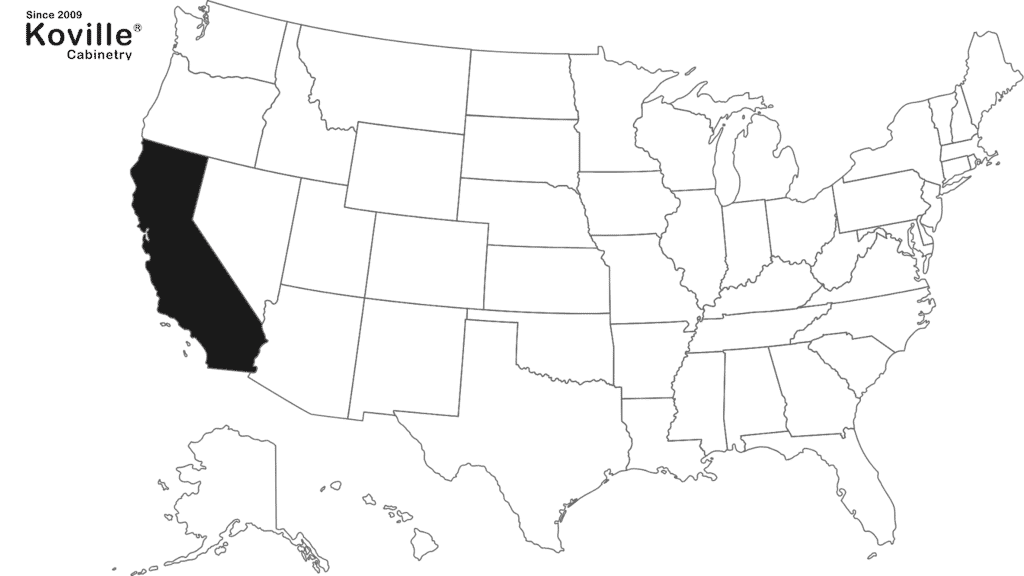

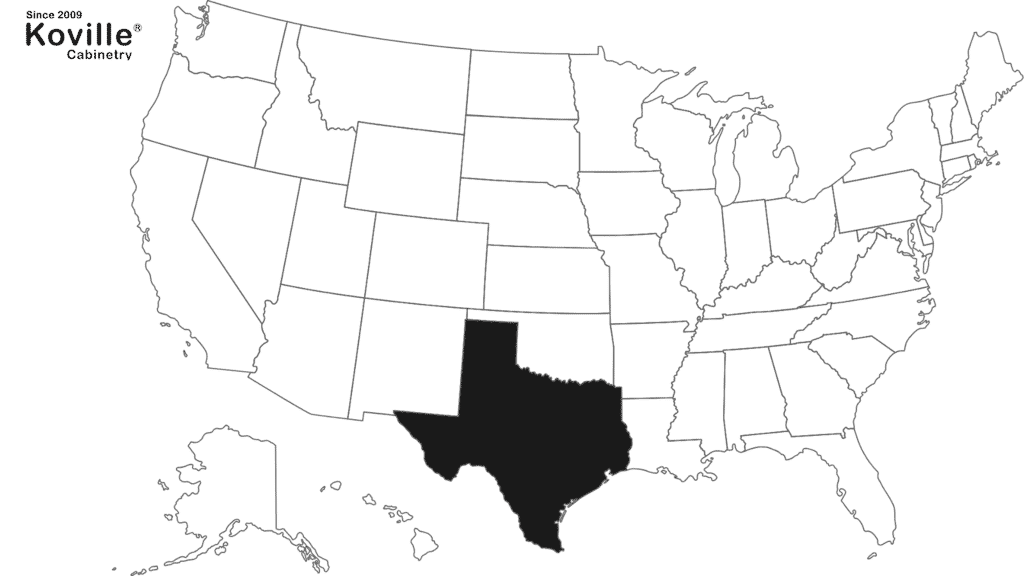

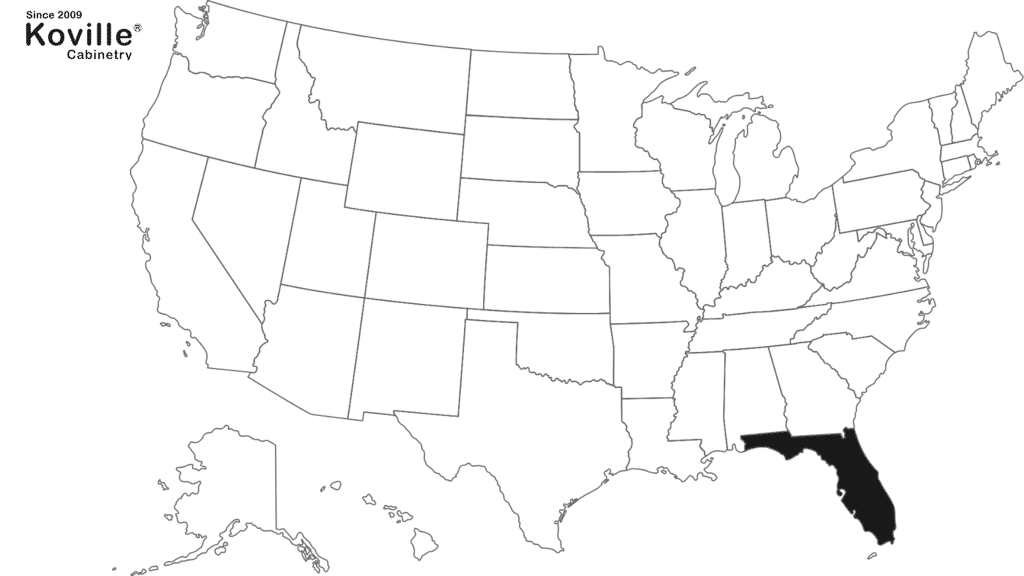

Record-Breaking Wood Product Exports

The Vietnamese timber and wood products sector saw a double-digit increase in export value throughout 2025. Vietnam has solidified its position as the world’s second-largest exporter of wooden furniture, driven by massive demand from the North American market. The industry has benefited from a strategic shift in global sourcing toward verified Vietnamese suppliers.

Source: VIFOREST (Vietnam Timber and Forest Product Association)

Stabilization of U.S. Trade and Tariff Policies

Successful negotiations between the Vietnamese government and U.S. trade representatives in 2025 reduced tariff uncertainties. These consensus-building efforts addressed Section 301 concerns, ensuring stable market access for Vietnamese wood manufacturers. This policy clarity has provided a much-needed boost for long-term B2B procurement contracts.

Source: Vietnam Ministry of Industry and Trade (MoIT) / U.S. Department of Commerce

Industry-Wide Adoption of International Quality Standards

In 2025, the adoption of professional certifications like ANSI/KCMA A161.1 became a standard requirement for major Vietnamese exporters. These certifications are now essential for factories aiming to enter the high-end U.S. construction and multi-family procurement chains. The focus has shifted from high-volume production to verified quality and structural integrity.

Source: International Code Council Evaluation Service (ICC-ES) / KCMA Industry Updates

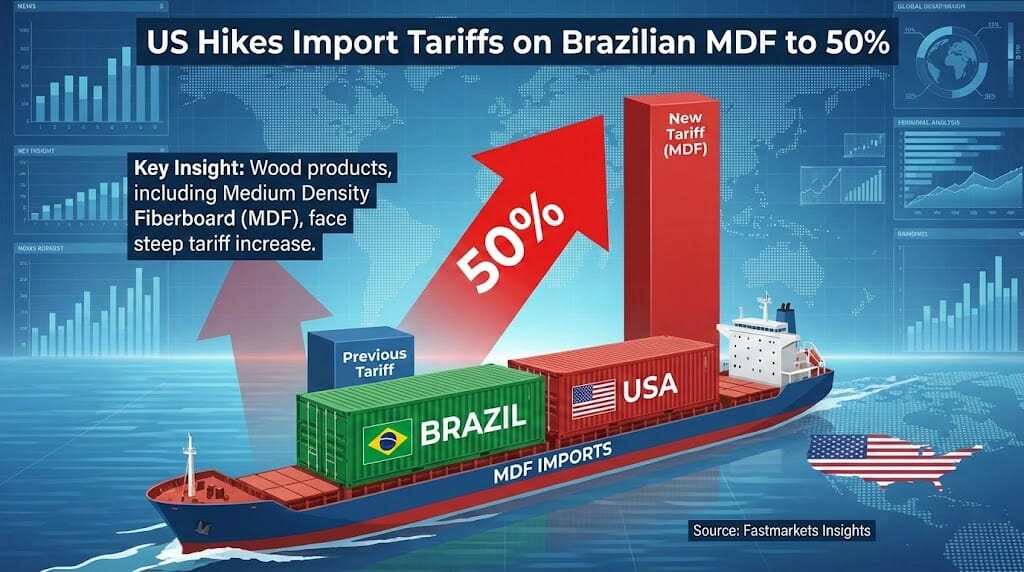

Expansion of Domestic Raw Material Supply Chains

Vietnam significantly increased its domestic production of plywood and fiberboard (MDF/PB) in 2025 to reduce reliance on imported materials. This expansion has improved the traceability of raw materials, which is a critical requirement for international compliance. Strengthening the local supply chain has also helped manufacturers better manage costs and lead times.

Source: Vietnam Woodworking Industry Portal / Ministry of Agriculture and Rural Development

Rigorous Enforcement Against Trade Circumvention

The Vietnamese government implemented stricter monitoring of timber origins in 2025 to combat illegal logging and origin fraud. Enhanced customs inspections ensure that all exported wood products meet stringent international “Rules of Origin”. This crackdown has protected the reputation of legitimate manufacturers and ensured fair market competition.

Source: Vietnam Customs Authority / International Trade Administration

Digital Transformation for EUDR Compliance

With the implementation of the EU Deforestation Regulation (EUDR), the Vietnamese wood industry adopted comprehensive digital tracking systems in 2025. These systems allow for precise geolocation and sourcing verification of timber products destined for global markets. Embracing these digital tools has become a prerequisite for maintaining access to the European market.

Source: European Commission Trade Circulars / Vietnam Forest Certification Office

Automation Counteracting Rising Labor Costs

To offset rising minimum wages, many Vietnamese factories made large-scale investments in smart manufacturing and robotics during 2025. Optimizing production process control has allowed the industry to maintain its competitive pricing despite higher overhead. This transition toward automation is ensuring the long-term sustainability of the manufacturing sector.

Source: Vietnam Association of Mechanical Industry (VAMI) / ILO Vietnam Report

Free Trade Agreements Driving Market Diversification

The continued utilization of the CPTPP and EVFTA agreements provided Vietnamese exporters with significant tariff advantages in 2025. These trade deals have allowed the timber industry to diversify its customer base beyond the U.S. into Europe and the Asia-Pacific region. Vietnam’s strategic position in these global networks remains a core pillar of its industrial strength.

Source: WTO Center Vietnam / Chamber of Commerce and Industry (VCCI)

Looking Ahead: Vietnam’s Enduring Industrial Vitality

Reflecting on 2025, Vietnam has demonstrated extraordinary resilience, maintaining robust economic growth and industrial vitality despite the complexities of global trade policies and shifting tariffs. Our on-the-ground observations reveal a clear strategic pivot within the cabinetry manufacturing sector, as production continues to centralize in Vietnam.

This ongoing trend is a direct testament to Vietnam’s stable socioeconomic backdrop and its pro-investment environment for foreign capital. As active participants in the Vietnamese investment landscape, we remain committed to providing timely updates and deep-dive insights into the latest industry dynamics.

— Andre Chi